Today’s Topic: Income Driven Repayment Plans, Congress and Student Loan Rates, Call For Action!

Most graduates are shocked when they get that call telling them it’s time to begin paying their student loans and how much they “have to pay” for their student loans. Many can’t pay the required amount so they enroll in an Income Income Driven Repayment Plan. Yes, it does help while you look for a better paying job, but it comes with a cost.

- “Income Driven Repayment Plans” – Under all of the Income-Driven Repayment Plans, your monthly payment amount may sometimes be less than the amount of interest that accrues on your loans. This is called negative amortization. Find out what happens to the interest that isn’t covered by your payment. I’ll give you a clue–it’s not good!

- “Negative Amoritization” – Under most income driven repayment plans the monthly payment does not cover the interest fees per month let along apply anything to principal. This is where borrowers get into trouble because their loan balance is increasing every month regardless of the payments received and it is due to negative amoritization.

ALERT! Did you know that Capitalization occurs when…

“You Voluntarily Leave” – If you voluntarily leave the Revised Pay as You Earn, Pay as You Earn (PAYE) or Income-Based Repayment (IBR) plans (learn more about income-driven repayment);

“You Fail To Annually Recertify” – If you fail to annually update your income for some of the income-driven plans (learn about recertifying your income); or

“You No Longer Qualify” – If you are repaying your loans under the PAYE or IBR plans and no longer qualify to make payments based on income.

NOTE: Loans in default are not eligible for any income based repayment or income-driven repayment plans. Find out how to get out of default.

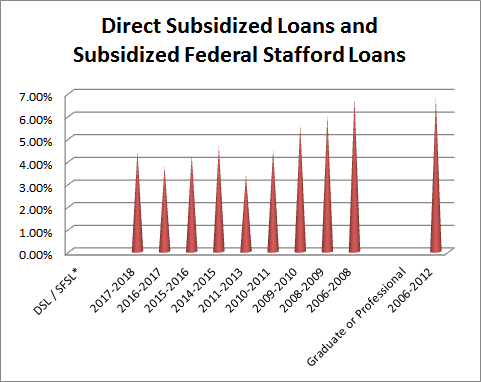

- “Congress & Student Loan Interest Rates” – Congress sets student loan rates every year based on the 10-year Treasury Note. Take a look at the interest rates, especially during the height of the recession from 2006 – 2010 and the Graduate degree interest rates.

Congress needs to find a relief valve for student loan borrowers. I’m not talking about forgiveness of loans (because that’s when the IRS steps in and now you’ve got a tax problem). Under former student loan plans borrowers were sent 1099’s because of loan forgiveness programs. What a shock that would be!

According to Market Watch’s, January 7, 2019 article 44 million Americans are struggling with $1.5 trillion in student debt. Now you understand why current and former students are stuck when it comes to buying a house, car, planning for retirement or looking to change jobs. After rent, utilities, car payments, daycare and medical expenses, there just isn’t anything left. For those trying to plan for retirement it’s even worse.

- “Call For Action” – With 44 million Americans struggling, we are a strong voice. Tell Congress to lower interest rates and change all loans to simple interest loans so students can actually pay off their loans. With the current way student loans capitalize, it makes it almost impossible to pay them off!

Contact your local Congressman/woman and tell him/her that we need relief now!

*Photo courtesy of MediaSalon.com