Using student loans for tuition, books and living expenses. Beware!

You are probably wondering why I am using the word “beware” when most students routinely use their student loans for tuition, books and living expenses. It’s pretty common, however, that extra $2,000 to $4,000 above the tuition easily slips through your hands for worthless things that you will regret later. Especially when you begin to realize the interest you are paying on that amount will capitalize causing the unpaid interest ($600) to double ($1,200) in one month, thereby increasing the total amount you owe (principal balance). It’s all because you had to have Starbucks every day, bought trendy clothing and shoes, and other things you really didn’t need as much as you thought.

I don’t know about you, but I have regretted taking the maximum loan amount for a few semesters while I was unemployed. I wish I would have done more that I did, especially knowing what I know now. As a matter of fact, I am about to make an extremely bold statement regarding my regret. Here it is…

I wish I would not have gone to college in my late forties. I also wished I would have done a little more research on how interest accrues and capitalization costs. Furthermore, the availability of scholarships and grants are almost non existent for single, white, females who are young seniors. I regret just “signing my name”.

Okay, I said it and I’m glad I got that off my chest. Looking back, I could have kicked myself for trading my future for the slavery of debt and for the rest of my life! Now you’re probably thinking that was a little harsh, but it is my reality and it will be yours too unless you wake up before it’s too late! My reality is that I will be paying my student loan debt well into my “golden years”. Yes, I mean retirement years! This just burns me and it is not a pretty sight!

The U.S. Department of Education makes it easy to obtain a loan and colleges are willing to sign up anyone with a pulse–or so it seems. Just signing your name didn’t require all the work I had to do to continue to make ends meet while unemployed. I felt like the rabbit while they had the perfect, orange carrot dangling on a string enticing me with only one little signature. Yes, I take full responsibility for signing something I didn’t really understand (capitalization) but I thought an education would make my life better. Add to that the stress of trying to find a job because I knew my situation couldn’t last much longer–I was on borrowed time. Do you see yourself in a similar situation and need some advice?

Here are some helpful tips for those who are struggling to stay afloat while in school OR are now repaying your student loan debt.

- Tuition debt only. If at all possible, only take out loans for tuition.

- Rent your books. This is the most cost effective way to significantly reduce your school expenses. Especially when you consider that after the semester is over the same book will only be worth half the amount you paid for it.

- Financial Aid. Go and see the Financial Aid counselor and tell him/her that you will have to drop out of school unless you receive a scholarship or grant. It’s amazing how they seem to find other resources for you.

- Visit the Foundation Office. Many students don’t even know that they offer scholarships based on need. (The money goes quickly, so get the details before the semester ends and the new one begins.)

- Apply for grants and scholarships online. There is “free” money out there but it takes time and persistence. (Find the Stars Scholarship Fund for your state.)

- For those really desperate situations. Sell some of your personal possessions, clothing and shoes. You’ll be surprised how much this can help. (I’ve used Facebook yard sale and Craig’s list.)

- Rent out one of your rooms. If you live in a house this will really help. If you live in an apartment, inquire about adding a roommate to your lease.

- Consider another side hustle. Many students and adults are supplementing their income with side hustles like Uber and Lyft or a part-time job.

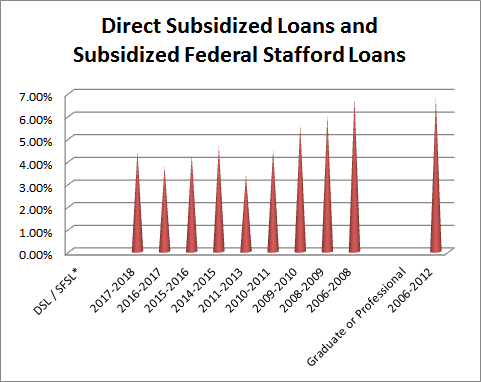

- Make interest only payments on your school loan debt. This is not the optimal situation, but at least the interest charged per month is not doubling. When interested capitalizes each month, you are paying interest on top of interest which increases your principal balance.

I hope this list helps and be sure to stop by for more student loan shark information you need to know!